VCCU Loan Services

Virginia Coop Credit Union offers a wide variety of financial products for our members. We offer loans for automobiles, motorcycles, ATVs, snowmobiles, boats, jet skis, fixed and variable rate home equity, and home purchases. We also offer fixed and variable rate unsecured loans, as well as credit cards and student loans. To find the right loan for you please call our office at 218-741-5644.

LOAN TYPES

We have a wide variety of loans and savvy staff to help match the loan that best fits your needs.

Get Pre-Approved

Put yourself in the driver’s seat when negotiating your next big purchase. Get your loan pre-approved!.

Home Equity Loans

VCCU offers both fixed and variable rate Home Equity Loans.

What is the difference?

Show More

Home Equity Loan – You get a lump sum at the time of the loan. You have a fixed payment and a fixed interest rate for the duration of the loan. Once you get the money, you can not borrow further from the same loan without refinancing. A home equity loan works very similar to an auto loan but has your home as collateral. It is perfect when you know how much you need to borrow at the time of the loan and do not anticipate to borrow more in the near future. You can use this to refinance your home for a lower interest rate, pay off your home before retirement, home improvements, and debt consolidation. Consult you tax advisor for tax deductibility.

Home Equity Line of Credit – A flexible option that allows you to access the equity in your home when you need it. A Home Equity Line of credit has a variable rate and the ability to access the money from the same loan more than once. Once you pay down a balance, you can borrow again. It works similar to a credit card with your home as collateral. It is perfect for the project where you will need to withdraw money more than once, have different cash flow needs at different times, or do not know the final cost of a project at the time of the loan. Home renovations are a great example of when to use a Home Equity Line of Credit. Consult your tax advisor for tax deductibility.

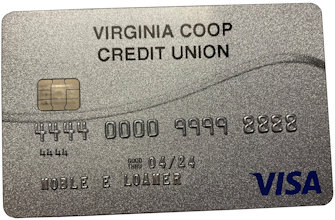

VISA Credit Cards

Virginia Coop offers a VISA card with no annual fee and annual percentage rates as low as 9.99%.

Show More

You can also apply online – simply choose Unsecured and enter ‘credit card’ as your Reason for Loan.

Apply Online (loan type ‘Unsecured’)

Access Your VISA Account Online

Stop in or call us at 218-749-5644 to get your new card today.

|

|

- Fixed-Rate Unsecured

- Variable-Rate Unsecured

- Credit Card

- Overdraft Line of Credit

We have FHA loans, VA loans, and other funding options available. Please call us at 218-741-5644 for rates and to talk to a home mortgage specialist.

Virginia Coop Credit Union – NMLS #728371

Donald Rausch – NMLS #747292

Ashley Fish – NMLS #1511355